If you are thinking about refinancing, you probably have a good reason. Maybe you are curious if you could save money by locking in a lower interest rate. Maybe you wonder if you could use some of the equity you have established in your home. Whatever your reason, here are 5 things to know before deciding if refinancing makes sense for you.

1. There are Good Reasons To Refinance

Not sure if Refinancing is a good idea? While refinancing may not be the best choice for everyone, there are a few good reasons to refinance.

A. A Shorter Mortgage Term

Maybe you are motivated to pay off your home sooner. If so, by refinancing to a shorter term mortgage (for example, a 15 year mortgage from a 30 year mortgage), you could set yourself up to be paid off in nearly half the time, depending on the maturity date of your existing mortgage.

Shorter term mortgages often come with smaller interest rates than their longer term counterparts. This can make the increased mortgage payment easily justifiable with the potential decrease of interest payments overall.

B. A Lower Interest Rate

Maybe you bought when interest rates were higher. While timing the market is a risky practice, at best, if the current average interest rates are significantly lower than the rate on your current mortgage, refinancing may look like an attractive option.

C. A Lower Monthly Payment

If your current mortgage is a few years old, refinancing into a new mortgage with the same term could reduce your monthly payment obligation. While this will likely increase the total interest you will have paid over time, the lower payment could free up cash for other expenses or goals.

D. Trade an Adjustable Rate for a Fixed Rate

If you opted for an adjustable rate mortgage due to a lower starting interest rate, you have likely noticed the periodic shifts, up or down, that your interest rate may have taken since originating your mortgage. If you are seeking a little more financial consistency, refinancing with a new fixed rate mortgage may be an appealing option.

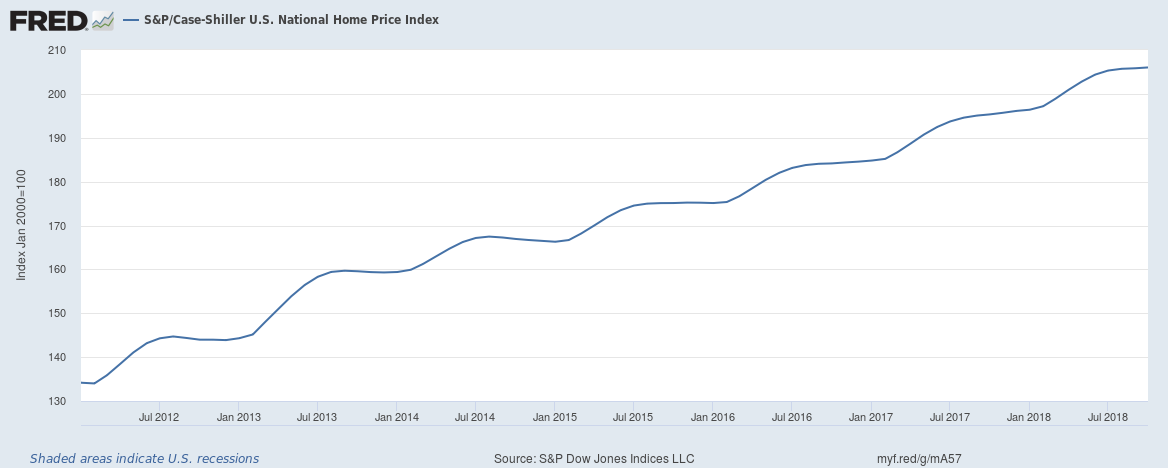

E. Access The Equity In Your Home

Has your home increased in market value since you bought it? Do you think your equity could be used better than being tied up in your home? A Cash Out Refinance may be for you. Mind the risk!

F. Consolidate Debt

Do you have other debt with higher interest rates? Do you think it would be a good idea to roll that debt into your mortgage instead? A Cash Out Refinance may be an appropriate option for you. Just like above, we strongly recommend that you mind the risk!

G. Drop Private Mortgage Insurance (PMI)

Low down payment mortgages are a great way to take advantage of the right opportunity, but it comes with Private Mortgage Insurance. In order to get a new loan without PMI, you will have to have at least 20% equity in your home. If you have that, dropping the added monthly expense for the PMI could help pay your home off sooner (with a shorter term mortgage), or result in more available cashflow on a monthly basis.

2. Pay Attention To The Term

The Amortization date (or the time until the death of the loan) is an important aspect to consider if you think you may want to refinance your home. A longer term (like the common 30 year mortgage) will have lower monthly payments, but means you will be paying more interest overall, and paying for more years. A shorter term, like a 15 year mortgage, benefits from less overall interest cost due to fewer interest payments. Shorter terms also often come with lower interest rates than their 30 year counterparts, helping you save even more over the long run. However, a shorter term also means higher monthly payments, as the principle is spread over a shorter period of time.

Deciding which term is right for you will depend on your monthly cash flow, and your personal goals. Your loan officer can help you to determine the right loan for you.

3. Crunch The Numbers

The costs associated with Refinancing can be complicated, when all is taken into consideration. If your goal is simply to save money, it may or may not make financial sense to refinance. Your loan officer can help you consider all facets that may effect the overall cost or benefit of a refinance.

If you are refinancing for a different reason, do the math to be clear on where you stand. A mortgage is a big commitment, and it’s a good idea to thoroughly understand the new agreement before jumping in.

4. Know The Break-Even Point

Total Closing Costs / Monthly Savings = Break-Even Point

The “Break-Even Point” is calculated by a simple formula, dividing the total closing costs by the monthly savings. The calculator linked below can help give you an idea about what your break-even point might be. This is the point in the life of the new loan where the new mortgage effectively pays for its own closing costs.

Why is this useful? If your goal is to save money, you may want to stay in your current mortgage if you plan to sell your home before the break-even point. Selling before you’ve reached the break-even point will end up costing you more overall.

5. Know The Risk

As mentioned earlier, a mortgage is a big commitment. There is always risk present when taking out a loan, especially when defaulting means losing your home. This is especially important to consider before taking a Cash Out Refinance to consolidate debt, especially debt that is not secured.

If you miss payments on a credit card, or student loan, you will have collectors giving you a hard time. If you the same debt is rolled into a mortgage, it becomes guaranteed by your home. Defaulting on a mortgage could result in losing your home. While consolidating high-interest debt into a low-interest mortgage can be a good long-term strategy, it may not be for everyone.

Be Smart: Talk To Your Benchmark Loan Officer Today

At Benchmark, we do more than sell a low interest rate. We look closely to help you determine the right loan for you. Even if you don’t feel ready, talking to us now can help you set a course for success.

Find your Benchmark branch, and contact them today for more information.Give us a call or contact us today. At Benchmark, we’ve got your back.Give me a call, send me an email, or request a call today. Along with my Benchmark community of mortgage pro’s, I’ve got your back.