If you rent, you probably have good reasons. I bet that “paying my landlord’s mortgage”, “noisy neighbors”, or other caveats aren’t among them. Look, we know that owning isn’t right for everyone. As much as we write about why owning a home is better than renting, there are legitimate reasons for choosing to rent. For one thing, while renting may require a deposit, it doesn’t require a down payment. Renting is often the first choice for someone who wants or needs to be able to move with minimal hassle, or for someone whose focus is too occupied to be concerned with managing repairs and maintenance.

Whatever your reason, there is little doubt that most people probably want to eventually own their own home, even if not yet. If your reason is financial, you may think that buying is more expensive than renting. On one hand, you may have a point. On the other hand, the long view casts a long shadow of doubt on that assumption. Even if you plan to rent for awhile longer, educating yourself is always a good idea, especially if you plan to one day own, rather than rent, your own home.

Let’s talk about it.

Costs of Buying and Owning

Let’s talk about equity.

Before we jump into the actually costs of buying and owning your own home, It would be shortsighted to not discuss how equity plays into the equation. For starters, if you don’t know what equity is, it is just the portion of a whole asset that you own. It can be calculated by subtracting the remaining loan balance from the total value of the home. This is a major reason why a Self-Made Millionaire Told Millennials To Buy A Home three years ago.

With every mortgage payment, a portion of it goes toward the principal balance of the loan. (See: Why Buying Is Investing) This means that, without any extra effort on your part, your net worth grows by the amount of the principal portion that you pay each and every month. How much of your rent adds to your net worth? Oh.. sorry, I didn’t mean to make you feel bad. When you rent, you add to your landlord’s net worth, not your own net worth. Hey, at least your money is helping someone, though, right? Let’s move on.

Do you need a lot of cash for a down payment?

That depends. How much how do you want to buy? How much do you consider to be a lot? The truth is, you don’t need as much as traditional wisdom may have led you to believe. In my last article, Owning A Home May Already Be Within Reach, I talk a little more about that. There are conventional loan programs that require as little as 3% down, depending on your particular scenario. Assuming a $250,000 purchase price, 3% amounts to $7,500. However, a down payment is just putting your own investment dollars into the transaction. A down payment reduces your liability, and while you will no longer have the cash in hand after the transaction, it will not reduce your overall net worth. On the contrary, it could be the vehicle that gets you on your way towards a higher net worth than you would have access to otherwise. See a previous article we published, called Homeowner Average Net Worth 3,600% Higher Than Renter.

What about closing and other transactional costs?

Ah, closing costs. Sometimes surprising first-time home buyers, the purchase of a home requires a lot of moving parts, and many parties who work together to make this transaction of real estate possible. Apply the economic principle of “There is no such thing as a free lunch” to the purchase of a house, and it’s logical, really. So how much are they? That all depends.

Generally speaking, home buyers will pay roughly 2-5 percent of the purchase price in closing and transactional costs. These can be seen as true costs, as they do not translate to equity in the purchased home. There is almost always room for negotiation on these, so it’s worth talking to your loan officer about this ahead of time. It is their job to put together a mortgage package that fits nicely with your own personal financial situation and goals.

There will be other costs of ownership.

When the plumbing needs work in your apartment, you know what to do. You either call your landlord, a property manager, or the maintenance number. At some point, someone will come to your apartment to do the necessary repairs. Simple.

When you own your home, you are on the hook for arranging the repairs yourself. Sure, there are home warranty packages you can purchase that cover certain repairs, but you’re on the hook for setting that up, too. Don’t be intimidated by this, though, because home warranty sellers are anxious to trade their promises for your hard-earned money. The debate about whether a home warranty is worth it or not is for another post.

Another option is to find your own contractor. This sounds like more work, but this is actually a huge advantage. Want to upgrade? Go for it. Find a killer deal? You’re free to call whoever you like. Depending on the repair, you may be able to DIY and learn a new skill while saving your money.

No matter which way you go about it, repairs and maintenance costs will come directly from your pocket. Do not gloss over this fact when considering how much house you can afford, or you might find yourself “house poor”. Remember, however, that homeownership is not a quick win. It is a long game of wealth accumulation. That’s probably not even the top reason why people buy homes. What’s your motive?

Opportunity Costs

Like every other decision you make, there is an undeniable opportunity cost to buying a home. When you buy a home, you’ve lost access to the money that you used as a down payment. Maybe you wanted to use that money to pay for college, start a business, or save for a rainy day. Then again, maybe you recognize that the better option for you is to put it into a real asset like a home.

Another factor to consider is flexibility. You lose the opportunity to move in a hurry. If location flexibility is important to you, it can be beneficial to only have to pay a fee to break the rental contract and go at your convenience. If you own a home, you will either need to keep paying the mortgage for a home you’re not living in while paying for rent or a new mortgage for a home in your new location, or you will need to coordinate the sale of your home with your planned move. When you sell, you are taking the equity you’ve accumulated in the home in cash, which is difficult to see the down side of. You can also potentially keep your previous home, and make it available to rent to someone who could then help pay the mortgage for you with your asking rent price.

Your situation is your own, and it’s your responsibility to decide what is best for you. I sincerely hope you find this article helpful when you make that decision.

Costs of Renting

There is no such thing as a free lunch, and there is also no such thing as a free home.* When you rent, the most obvious cost to you is just that: rent. Whether you think your rent is a good deal, or whether you think it’s too high, the rent must be paid. Your rent helps pay for your landlord’s mortgage, adding to his (or her) net worth. Unfortunately, there is no long term fiscal benefit to the rent payment. It especially doesn’t help when the rent price goes up.

* Unless you live with family.. or other less common exceptions.

Lack of Privacy

Since your home is not your own, you are at the mercy of your landlord, their property management, and local laws for your personal safety and security. Have you ever heard your neighbors arguing through the wall? Has a party gone on in the unit above you until well past a reasonable hour? Do the neighbors’ kids not understand what ‘courtesy’ means?

See: Owners Enjoy More Privacy and Security.

I’m not saying that buying means you get to choose your neighbors, but you can at least choose your neighborhood, and buy a single family home with no attached neighbors, if that’s what you want to do. If you buy a house with a yard, you have a green space to enjoy without having to go to a public park or courtyard just to enjoy the fresh air.

No Personalization

If you rent, you give up the option to really make your (well, your landlord’s) home your own. Do you want to change the paint color, wallpaper, tile, or carpet? You have to either get permission, do the work yourself, or both. With the costs involved, you probably won’t want to invest in your landlord’s equity with your own cash. I don’t blame you, especially since one of the benefits of renting is its transient nature.

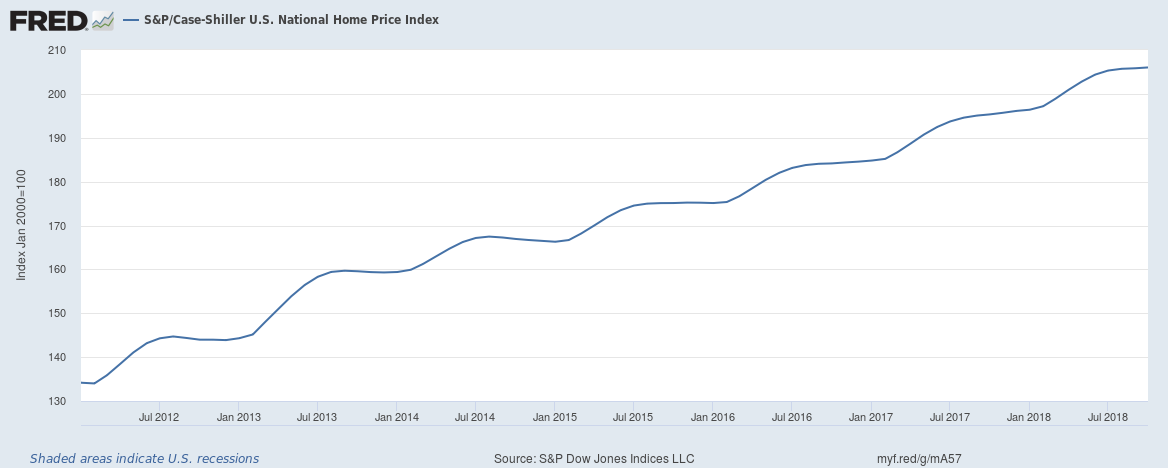

Opportunity costs

Renting means giving up any future possible financial gains on your residence, because it’s not yours. (see: This New Year, Reach Your Dream of Homeownership for a little math on this). It’s possible that you can see any of the previous costs as opportunity costs as well. With a financial stake in your community, you will be more invested in the culture and politics of your neighborhood and your hometown. This is not to say that you cannot also be personally invested if you rent, but that may come from owning or operating a local business rather than renting a home.

The Answer Is Ultimately Subjective

“Expensive” is relative. Expensive compared to what? Does buying a home come with a lot of cost, including upfront costs? Yes. Is it cheaper to pay rent, without gaining equity, for decades? No. However, is the cost worth it to you? Ultimately, that’s the question, isn’t it? I don’t know your particular life circumstances, goals, or timelines. However, you do. This is an answer you will need to arrive to on your own, based on your own priorities.

More recommended reading: Rent or Buy? A Fool, Do Not Be

If you are curious to see specific numbers to bring clarity, you will want to talk to one of our mortgage professionals. At Benchmark, our loan officers specialize in tailoring the best matching loan arrangement for your personal goals and financial situation. Find your branch, and contact them for more information.Contact us today. It would be our honor to help you decide what’s best for you.Please call me or request a call. I would be honored to be part of helping you decide what’s best for you.

Benchmark brings you home.