The insurance industry has experienced significant changes over recent years, with homeowner’s and auto insurance rates increasing rapidly. The reasons behind these trends are numerous, involving a combination of economic, environmental, and market-driven factors.

Homeowner’s insurance on the rise

Homeowner’s insurance rates have risen notably, driven by several unrelated critical factors:

- Rising Rebuilding and Replacement Costs: Between 2019 and 2022, the costs associated with rebuilding and replacing homes climbed by 55%1. This increase is a principal driver behind higher premiums as insurers recalibrate to cover these escalated costs.

- Extreme Weather Impacts: A rise in natural disasters, including severe storms and wildfires, has heavily impacted the insurance sector2. The increase in these catastrophic events have lead to more large claims, driving up costs for insurers. Costs which, in turn, get passed on to homeowners.

- Market Pressures and Area Exits: Worsening financial performance has caused property insurance market to experience significant strains, which are partly due to economic inflation and changes in exposures3. These pressures have resulted higher premiums and, in some cases, insurers exiting certain markets (no longer writing polices in certain regions) or reducing their policy offerings4.

Accelerating auto insurance premiums

Auto insurance has also experienced rate increases, with overlapping and unique factors to blame:

- Rising Inflation and Repair Costs: Similar to homeowners insurance, auto insurance is impacted by inflation. The cost of repairs, labor, and parts has increased, leading insurers to raise premiums to cover these higher expenses5.

- More Natural Disasters: Auto insurance companies were also impacted by natural disasters, which can lead to a higher volume of claims. Vehicles damaged by storms, floods, or fires contribute to the overall risk insurers need to manage5.

- More Technological Complexity: Modern vehicles come equipped with advanced technology, making repairs more expensive. This novel complexity adds to the overall cost insurers need to cover, contributing to premium increases.

Common themes and relationships in insurance

Analyzing the causes behind the steep rise in both homeowners and auto insurance rates reveals common themes:

- Impact of Weather Extremes: Both sectors are significantly affected by climate change, leading to an increase in natural disaster-related claims. This trend underscores the growing importance of environmental factors in insurance pricing.

- Economic Factors: Inflation plays a crucial role in both contexts, impacting the cost of repairs, replacements, and labor. Economic conditions directly influence insurance rates, reflecting broader market dynamics.

- Technological and Material Costs: Just as the cost of modern vehicle technology impacts auto insurance, the rising costs of building materials and construction technology affect homeowners insurance. These factors contribute to the overall increase in premiums.

Looking ahead

Understanding these trends is critical for consumers looking to navigate the changing insurance landscape effectively. While external factors like climate change and inflation may be beyond individual control, there are steps consumers can take to mitigate the impact on their insurance rates. Regularly reviewing policies, improving property resilience, and shopping various insurance providers can help secure more favorable terms.

Given the complex interplay of factors driving insurance rates up, it’s evident that both homeowners and auto insurance sectors are navigating through a period of adjustment. Awareness and proactive management of insurance policies become even more crucial to adapt to these changes.

What’s a future homeowner to do?

It’s no secret that inflation has taken a bite out of the average worker’s spending power. The general cost of living is, on average, higher than it used to be. See the chart below of the latest 5-year trend of the Consumer Price Index in the United States using data from the US Bureau of Labor Statistics:

United States Consumer Price Index: Last 5 Years

source: tradingeconomics.com

If you currently rent your home, you may also have noticed that the average cost to rent has risen as well. Below is a chart of Rent Inflation for the past 5 years, again, using data from the US Bureau of Labor Statistics:

United States Rent Inflation: Last 5 Years

source: tradingeconomics.com

If you are feeling the pinch of inflation and rent increases, you may be tempted to believe that the American Dream of homeownership is slipping away. Headlines have emphasized the increase in mortgage rates, and it’s no secret that demand has buttressed home prices, as indicated in the chart below using data from the Federal Housing Finance Agency (FHFA):

United States FHFA House Price Index: Last 5 Years

source: tradingeconomics.com

What if you could do something now to help prepare for a more expensive future? What if homeownership is more than just a foundational part of the American Dream, but a tool to leverage a better financial future for family, or just for yourself?

Fight rent increases: Fire your landlord. (and become your own)

Maybe you love your landlord. Maybe you really dislike your landlord. Either way, the odds are good that your rent is higher than it was 2 years ago (Remember the rent inflation chart above?).

You know what isn’t higher? The principle and interest monthly payment for a mortgage that started 2 years ago. That’s the magic of a mortgage loan: the monthly payment doesn’t change for the life of the loan. Sure, this doesn’t account for insurance rates, taxes, or HOA fees, but every dollar you pay on the principle is equity in your home that you now own, and your lender doesn’t. You can’t say that about rent.

Your home as a financial asset

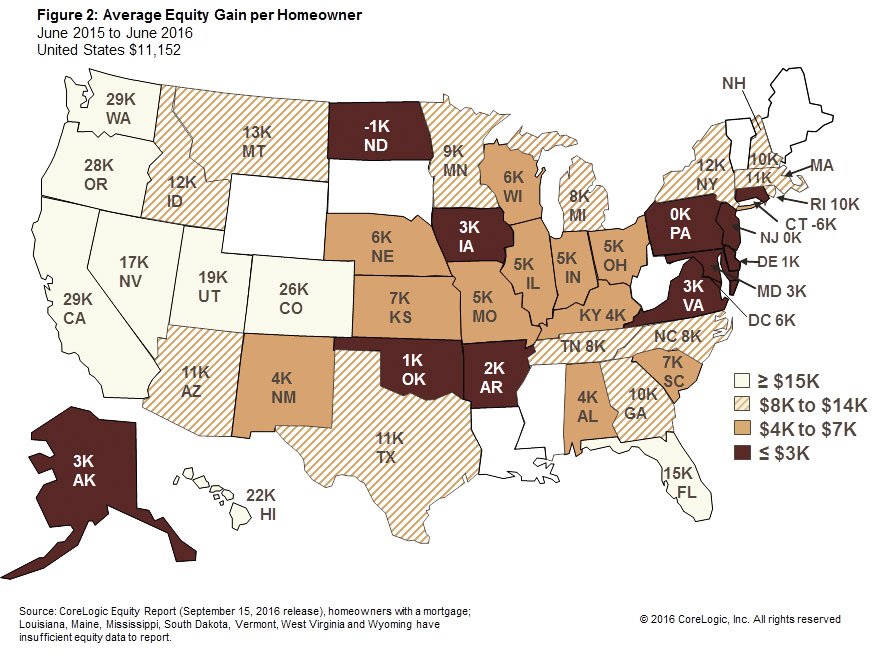

As the property you own increases in value, you own every bit of the new value, and your monthly payment (principle and interest) stays the same. Maybe you have a growing family, or you want a bigger garage, office, space to entertain, or whatever you have your heart set on. If you want to get a bigger house, you can take the equity of your existing house, and use it to help pay for your next house.

Over time, as your equity grows (and your monthly principle and interest payment stays the same), your net worth and economic resilience grows with it. In fact, if you want an even lower monthly payment, you may be eligible to refinance your remaining debt into a new mortgage, if rates are favorable. You could also use a portion of the equity in your home for other expenses. (These are referring to various loan products, and the best product for your situation may not be the same the best option for someone else.) The point is, becoming a homeowner gives you options that are not available otherwise.

Know your options

If you firmly believe that homeownership is out of reach, we encourage you to explore your options anyway. There are a variety of programs, and a variety of properties that can work together to help you start building home equity. If qualification is a problem, there are steps you can take to work towards qualification.

The point is, don’t let your own limiting beliefs hold you back. Our team of loan experts thrive on helping buyers overcome challenges to help you fire your landlord, become a homeowner, fight back against rising rents, and start building equity.

If you are ready to get started, fill out our no-obligation form, and your mortgage loan expert will contact you to help you determine your best path forward.

After all, Benchmark brings you home.

1 CNN, 2023

2 CNBC, 2024

3 Financial Research Government, 2023

4 Money.com

5 NPR, 2024