Now, you could get a refinance loan for any term between 15 and 30 years! Get a better rate without "starting over". Benchmark presents: Odd Term Mortgages.

Now, you could get a refinance loan for any term between 15 and 30 years! Get a better rate without "starting over". Benchmark presents: Odd Term Mortgages.

Yesterday, December 7, 2017, the Federal Housing Administration announced that for 2018, 3,011 out of 3,141 counties in the U.S. (~96% of all counties in the nation) will see an increase in FHA loan limits. Ceilings and Floors In high-cost areas, the FHA’s loan limit ceiling will increase this year to $679,650, up from $636,150, …

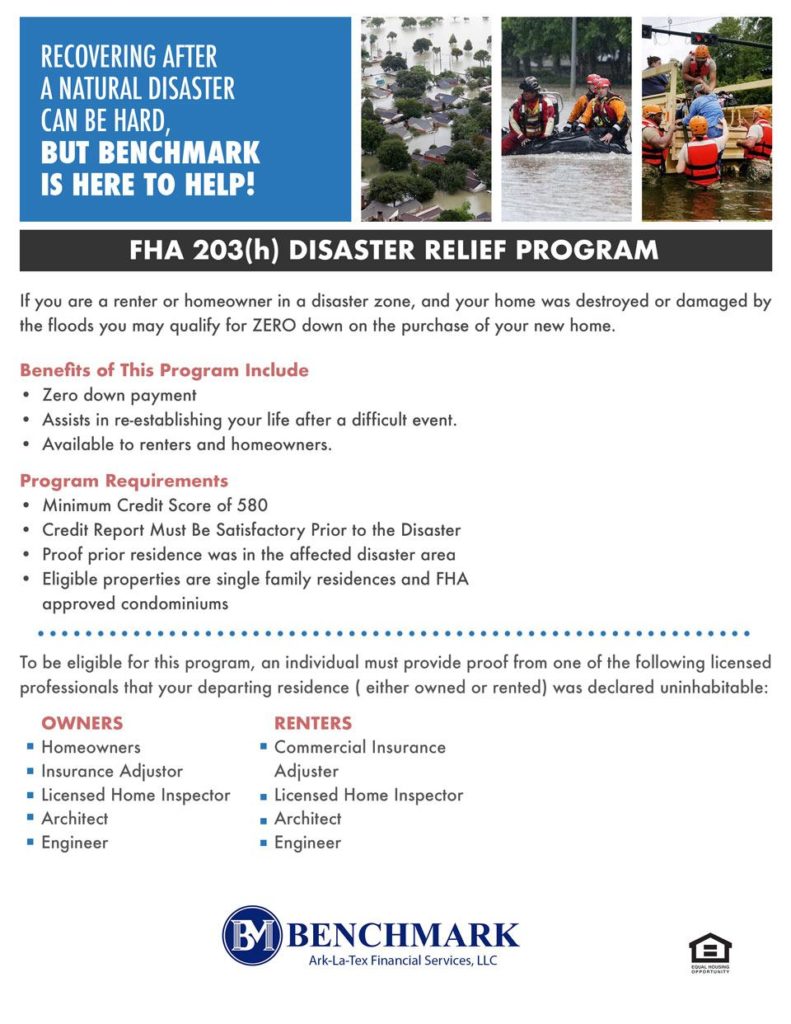

In the aftermath of the historic flooding in South Texas, and in anticipation of Hurricane Irma in the Caribbean, you should be aware of your financial options in the wake of devastation. The FHA 203(h) is a ZERO down program, and is available to homeowners and renters alike. At Benchmark, we know how important …

[UPDATE – According to Housing Wire, This reduction has been indefinitely suspended mere minutes after Donald J. Trump was sworn in as the 45th President of the United States of America.] The Department of Housing and Urban Development announced on Monday that they plan to reduce the Mortgage Insurance Premium for FHA mortgage loans. Since 2012, …

The Federal Housing Finance Agency has announced that it is increasing the maximum conforming loan limits for mortgage loans beginning in 2017. A mortgage loan is considered “conforming” when it is eligible to be acquired by Fannie Mae and/or Freddie Mac. (Mortgages are often sold to Fannie or Freddie so that a lender has the liquidity/money available …