Not only has the housing market made a strong economic recovery, but also in consumer and expert confidence in home-ownership as an investment.

Not Because of a Difference in Lifestyle

In the New York Times, an editorial entitled, “Homeownership and Wealth Creation” explains:

“Homeownership long has been central to Americans’ ability to amass wealth; even with the substantial decline in wealth after the housing bust, the net worth of homeowners over time has significantly outpaced that of renters, who tend as a group to accumulate little if any wealth.”

The Federal Reserve’s Own Research Agrees

While we have referenced this article before, many of the claims that the article makes are backed by the research that the Federal Reserve has conducted in their Survey of Consumer Finances. The study found that,

the average net worth of a homeowner ($194,500)

is 36x greater than that of a renter ($5,400).

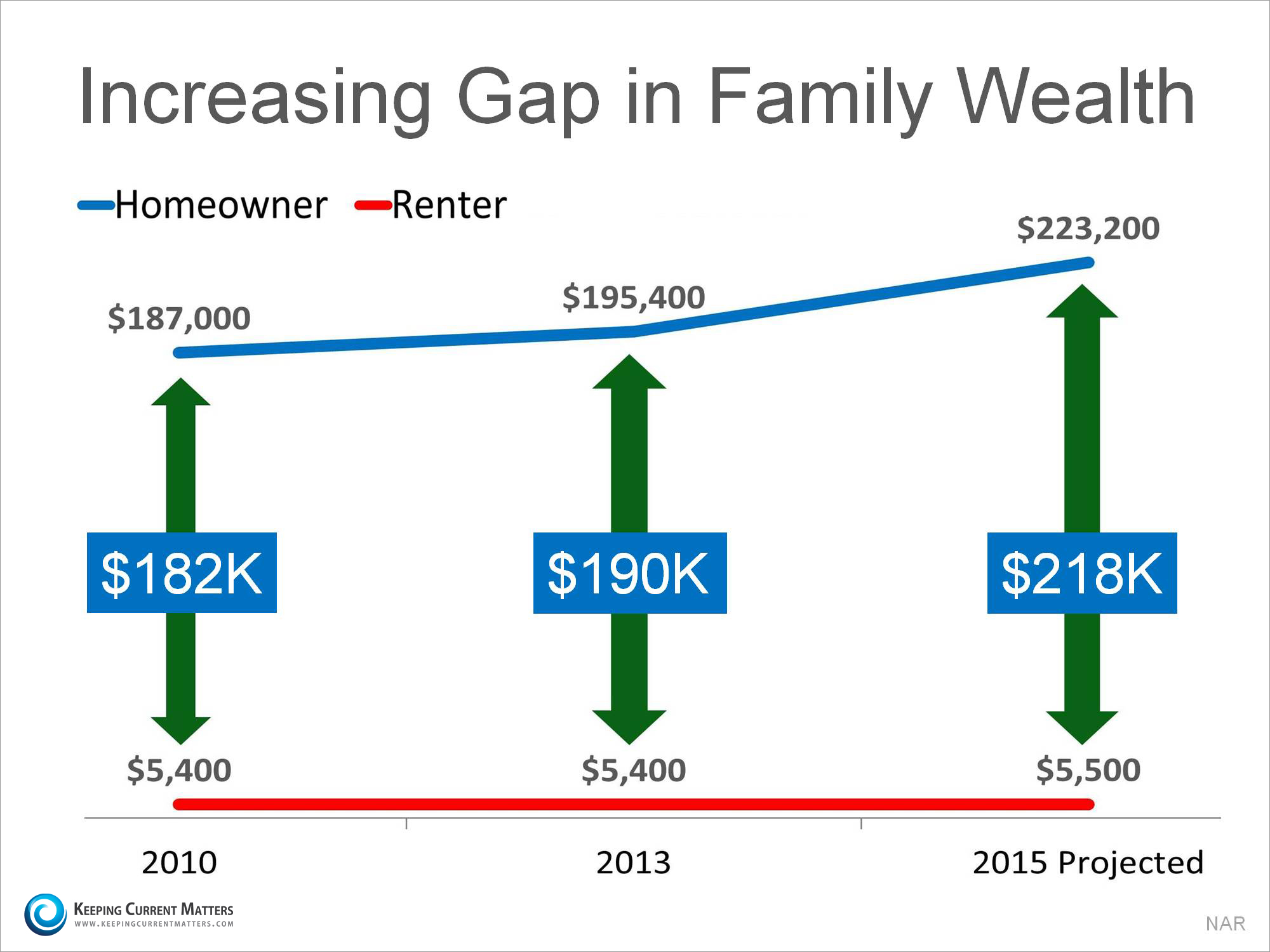

The National Association of Realtors (NAR) expanded on the Federal Reserve’s research and projected that,

by the end of 2015, the average homeowner will have nearly

41x the net worth of a renter.

That’s nearly 4,100%!

The Gap Widens

Their findings are detailed in the graph below:

One reason for this large discrepancy in net worth is the concept of ‘forced savings’ created by having a mortgage payment and was explained by the New York Times:

“Homeownership requires potential buyers to save for a down payment, and forces them to continue to save by paying down a portion of the mortgage principal each month.” “Even in instances where renters have excess cash, saving a substantial amount is difficult without a near-term goal, like a down payment. It is also difficult to systematically invest each month in stocks, bonds or other assets without being compelled to do so.”

The Takeaway

“As a means to building wealth, there is no practical substitute for homeownership.”

If you are a renter who is considering making a purchase, talk with a Benchmark Mortgage professional who can explain the benefits of signing a contract to purchase over renewing your lease.

click here to find yours