Every year begins with renewed hopes and bright aspirations embodied by the shared cultural vow we all seem to take: the New Year’s Resolution. If your Resolution involves any aspect of ‘home’ or financial strategies, purchasing your first home and homeownership may be on your mind.

You Are Not Alone

Among renters under the age of 50, 72.7% reported a preference for buying, with 52.5% reporting that they strongly prefer buying, and the remaining 20.2% reported a normal preference. If you are like most other renters under the age of 50, the odds are good that you would prefer to own a home, even if you currently rent. Is homeownership right for you?

(source: https://www.newyorkfed.org/microeconomics/sce/housing#indicators/Renters/g42)

Is Housing A Good Investment?

Attitudes toward housing as a financial investment became more positive than they already were: 65% of all respondents think that buying property in their zip code is a “very good” or “somewhat good” investment, compared to 60% in 2016. Only 10.6% think housing is a “bad” investment. Enthusiasm about housing as investment is particularly pronounced among younger, more educated (Bachelor’s degree or more), and higher-income (annual income of $60,000 or more) households. – source: https://www.newyorkfed.org/newsevents/news/research/2018/an180418

While it is not our (Benchmark) place to recommend any investment strategy, Americans seem to view homeownership as a favorable investment overall. You can read these posts from our archive for more information on this:

Renting vs Buying a Home and Accumulating Wealth

Buying Still Cheaper Than Renting

Homeowner Average Net Worth 3,600% Higher Than Renter

Why Buying Is Investing

Can You Afford To Buy?

One of the biggest hurdles in a market where property values have been on the rise is having enough cash for a down payment. The median listing price in the United States is $276,000 (retrieved from https://www.zillow.com/home-values/ on January 4, 2019 at 4:12pm). So, how much down payment is required?

Related: Nervous About Buying? Here’s A Dose of Confidence

Most people tend to believe that you need 20% of a home’s price for a down payment. ApartmentTherapy.com created the following table based on the assumption of the median home price for each state, 20% of the down payment, and how much one should save each month for six and a half years. (If you are just starting in January 2019, you won’t be ready with your 20% down until the buying season is in swing in 2025.

| State | Median Home Price | Down Payment | Monthly Savings Plan |

| Alabama | $171,500 | $34,300 | $440 |

| Alaska | $267,404 | $53,480 | $686 |

| Arizona | $225,000 | $45,000 | $577 |

| Arkansas | $156,000 | $31,200 | $400 |

| California | $462,000 | $92,400 | $1,185 |

| Colorado | $331,000 | $66,200 | $849 |

| Connecticut | $253,500 | $50,700 | $650 |

| Delaware | $210,000 | $42,000 | $539 |

| Florida | $218,000 | $43,600 | $559 |

| Georgia | $193,000 | $38,600 | $495 |

| Hawaii | $442,500 | $88,500 | $1,135 |

| Idaho | $349,000 | $69,800 | $895 |

| Illinois | $212,000 | $42,400 | $544 |

| Indiana | $190,843 | $38,168 | $490 |

| Iowa | $157,000 | $31,400 | $403 |

| Kansas | $187,649 | $37,529 | $482 |

| Kentucky | $170,000 | $34,000 | $436 |

| Louisiana | $232,610 | $46,522 | $597 |

| Maine | $275,717 | $55,143 | $707 |

| Maryland | $379,000 | $75,800 | $972 |

| Massachusetts | $150,000 | $30,000 | $385 |

| Michigan | $164,000 | $32,800 | $421 |

| Minnesota | $240,000 | $48,000 | $616 |

| Mississippi | $195,390 | $39,078 | $501 |

| Missouri | $204,506 | $40,901 | $525 |

| Montana | $314,959 | $62,991 | $808 |

| Nebraska | $178,000 | $35,600 | $457 |

| Nevada | $249,300 | $49,860 | $640 |

| New Hampshire | $245,000 | $49,000 | $629 |

| New Jersey | $290,000 | $58,000 | $744 |

| New Mexico | $254,798 | $50,959 | $654 |

| New York | $430,000 | $86,000 | $1,103 |

| North Carolina | $210,000 | $42,000 | $539 |

| North Dakota | $226,863 | $45,372 | $582 |

| Ohio | $154,900 | $30,980 | $398 |

| Oklahoma | $150,000 | $30,000 | $385 |

| Oregon | $315,000 | $63,000 | $808 |

| Pennsylvania | $191,000 | $38,200 | $490 |

| Rhode Island | $256,000 | $51,200 | $657 |

| South Carolina | $181,500 | $36,300 | $466 |

| South Dakota | $177,500 | $35,500 | $456 |

| Tennessee | $190,000 | $38,000 | $488 |

| Texas | $320,067 | $64,013 | $821 |

| Utah | $440,946 | $88,189 | $1,131 |

| Vermont | $325,000 | $65,000 | $834 |

| Virginia | $297,500 | $59,500 | $763 |

| Washington | $332,719 | $66,543 | $854 |

| West Virginia | $136,500 | $27,300 | $350 |

| Wisconsin | $197,000 | $39,400 | $505 |

| Wyoming | $291,855 | $58,371 | $749 |

table and data copied from: https://www.apartmenttherapy.com/home-down-payment-cost-by-state-2018-261916

The Cost of Waiting

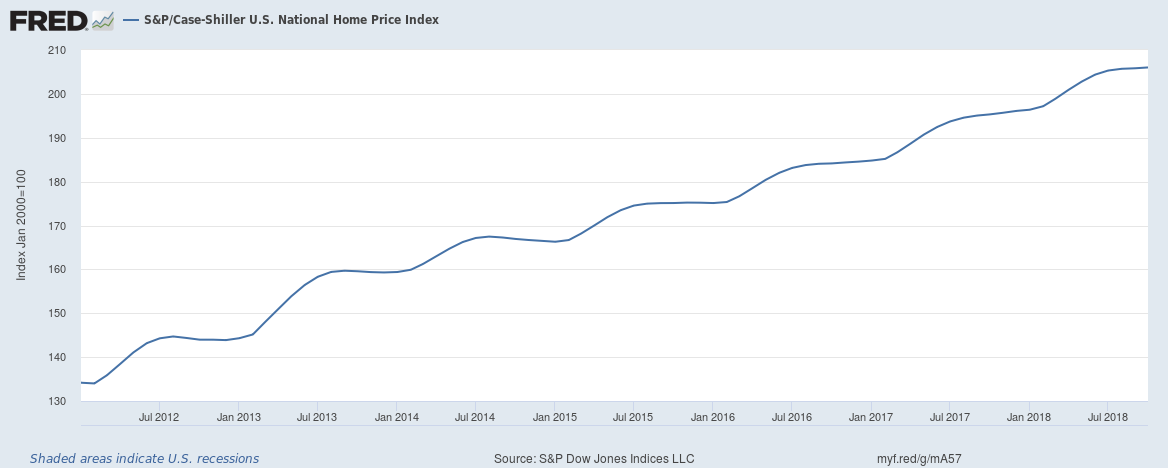

When looking to put 20% down, consider the cost of waiting six years. Since January 2012 until January 2019, the national home price index has inflated by 53.56%.

source: https://fred.stlouisfed.org/graph/?g=mA5v

If you have owned your home for a few years, this is wonderful news! If you have been saving for a 20% down payment on a home that was listing for $134k in 2012, it is now likely going for $206k, and your 20% down payment has gone from $26.8k up to $41.2k. How would this factor into your savings plan if you took the advice of the table provided above?

Will home prices continue their upward climb? No-one knows. If it does, you could miss out on equity gains and purchase opportunities while saving for a 20% down payment. Is there an easier path to homeownership? What if you didn’t have to put down 20% to get a mortgage?

You Don’t Always Need 20% Down*

If you qualify for a Conventional mortgage loan (based on a variety of factors, including credit score, income, debt, and financial history), there are products available for as little as 3% down!*

For first time home buyers, an FHA mortgage requires as little as 3.5% down, and require a minimum credit score of less than 600!*

Let’s take a look at this practically.

Assuming a list price of $276,000.00, 3% down equates to $8,280. If you were following the 6.5 year plan towards 20% down, you would be saving $707.69 every month for 78 months. BUT, if you plan to put 5% down instead, you could get there in only 19.5 months following the same savings plan. That makes you a homeowner ~5 years sooner!*

0% Down Programs

If you are a Veteran who qualifies for a VA Mortgage Loan, it is possible to buy with 0% down.

USDA loans are also candidates for 0% down qualification.*

Down Payment Assistance

Down payment assistance programs may be available in certain counties and states. Ask your Benchmark loan officer if there are any available in your area.

This Year, Make Your Dream A Reality

Even if you don’t have enough for a down payment, if you think your debt is holding you back, or if you don’t think your credit is good enough, let’s chat.

Find your branch, and contact them today. If you are ready, you can click to Apply Now. We look forward to helping you reach your goals!Call or email us, or Contact Us today. If you are ready, you can Apply Now. We look forward to helping you reach your goals!Call me, Email Me, or Contact Me today. If you are ready, you can Apply Now. I look forward to helping you reach your goals!

* Ark-La-Tex Financial Services, LLC NMLS ID #2143 (www.nmlsconsumeraccess.org) is not a law firm, accounting firm, tax firm, or financial planning firm. This advertisement is for general information purposes only. Anyone relying on particular details contained herein does so at his or her own risk and should independently use and verify their applicability to a given situation. All loans are subject to borrower qualifying and meeting appropriate underwriting conditions. This not a commitment to lend. Some products may not be available in all licensed locations. Information, rates, and pricing are subject to change without prior notice at the sole discretion of Ark-La-Tex Financial Services, LLC. Other restrictions may apply. (https://benchmark.us)