With mortgage interest rates at a level not seen for over a decade (see chart below), the question of whether to wait for interest rates to fall is creeping in. This is not unreasonable, however, it does beg the question.

Are rates actually high?

If you take a look at the chart below, you can get a pretty good idea. At first glance, you may be tempted to think, “With rates THIS high, they’re bound to come back down before too long.” You may think this looks like an economic blip; that things will calm down back to normal soon.

10 Year chart of mortgage interest rates

source: tradingeconomics.com

But a longer view may give you a different perspective.

Looking over the past ten years means we are looking back on a housing market recovering from the 2008 crash (the conditions of which do not exist today). This is a short-term view; A view that includes a lot of market manipulation intended to encourage buying through various means, including keeping interest rates low.

To see more clearly, we need to take a look at a much longer time frame.

25 year chart of interest rates

source: tradingeconomics.com

The longer view gives a sobering realization. Current rates do not appear to be high at all, in the long term. The reality is that the lower rates we’ve been experiencing are a strange occurrence, fueled by quantitative easing. The rising rates we see now are the result of a slight reversal of this practice. To better understand what this really means, take a look at the chart of the Federal Reserve’s Balance Sheet over the last 10 years below.

10 year chart of Federal Reserve balance sheet

source: tradingeconomics.com

The Federal Reserve was buying investment securities (including mortgage debt securities) to help prop up the economy, and to bring mortgage interest rates down. The fact that the strategy worked is a clear sign that its reversal means that rates have, and will probably continue to drift back up to natural market levels. As we have discussed before, a rising interest rate means a rising cost of homeownership.

However, it’s clear that interest rates are not the only thing going up.

Inflation is a value killer

Inflation is on everyone’s minds as of writing. The Consumer Price Index shows a fairly sharp climb since the COVID-19 pandemic began, and the Federal Reserve’s increase in interest rates (not the same as mortgage interest rates) was intended to alleviate inflation. Oh, you want a chart to show inflation? See below.

5 Year chart of Consumer Price Index

source: tradingeconomics.com

The rising prices means that your money is worth less. Everything costs more than it did, which can eat into what you can afford for a monthly mortgage payment. It may seem like a good idea to wait: for your money to be worth more, for the economy to stabilize, and for mortgage interest rates to return to their senses.

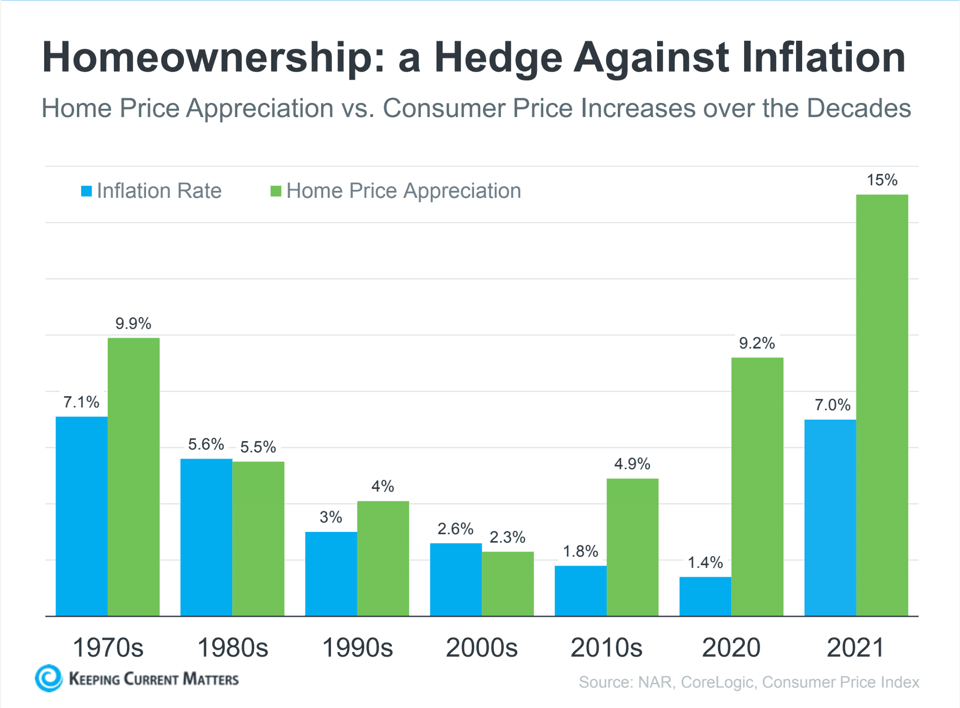

As discussed previously, however, there is no solid basis for anticipating mortgage rates to come down any time soon, if at all. If this is true, though, does it even make sense to buy a home? Is real estate really the right place to put your money if the cost of living goes up?

Rising prices mean cash held in hand is losing value, while investments that rise with it are, at the very least, holding value.

“Real estate is one of the time-honored inflation hedges. It’s a tangible asset, and those tend to hold their value when inflation reigns, unlike paper assets. More specifically, as prices rise, so do property values.”

Mark Cussen, Financial writer at Investopedia

Higher cost (rates) means less competition

We have seen a cooling of demand in the housing market since rates have started rising. The sellers’ market has become more equitable, favoring buyers in many locations. There have been fewer multiple-offer scenarios, and even when there are multiple-offers, there have been fewer offers to compete with.

If you live in a competitive market, Benchmark can give you an edge. If you don’t live in a competitive market, this could be your opportunity to get your offer accepted on the best possible terms. Again, this is what we do best. Contact us get more information about how you can win with Benchmark.

Housing prices tend to climb

The financial world is full of commonly repeated advice. Invest early and invest often. The best time to plant a tree is 20 years ago; the second best time is today. Add this one to the list: Buy now to buy more.

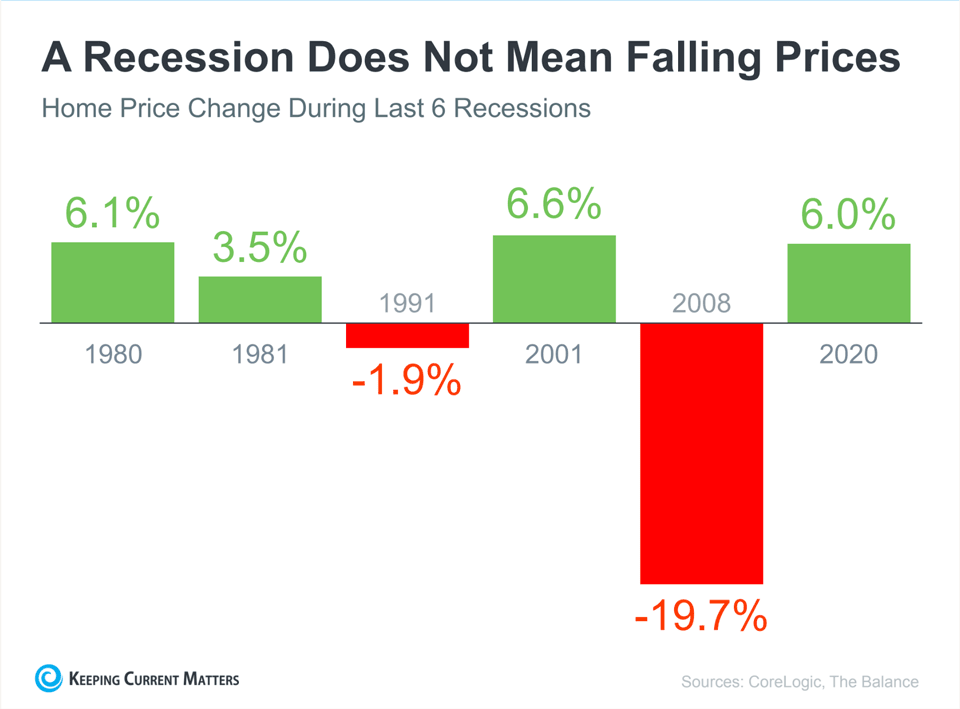

Even if we find ourselves in a recession, as some predict, this does not guarantee falling home prices. The exception being the notorious 2008 recession due to the collapse of real estate debt-based investment schemes, the conditions of which do not exist, and have not existed since.

Buying a home is not just about building family wealth. Owning your own home comes with other benefits. Owners Enjoy More Privacy and Security, for example.

Will interest rates come down?

There is no indication that they will come down any time soon. Even if you do suspect that rates will be reduced in the future, you should weigh the cost of waiting. Of course, you may be able to refinance at a lower rate in the future, while taking advantage of current home prices now.

Either way, your rent payment will become at least a partial investment into a physical asset you own. The principal portion of a mortgage payment directly reduces the amount you owe on your home. When you pay rent, the only equity you are building is your landlord’s.

Not to mention, rent also rises.

10 Year Rent Inflation Chart

source: tradingeconomics.com

The chart above is not plotting rent prices. The chart is plotting rent price inflation. See the dip caused by the COVID-19 pandemic starting early 2020? This isn’t really a dip; it’s just a reduction in the annual inflation rate of rent prices. Inflation never reversed within the last decade.

How do you escape the squeeze?

It would do no good to lie to you and tell you that there is an easy way out of the rising cost of housing. We have published a short list on How to Get Ahead When You Can’t Get the House You Want, but the wisest words I’ve ever read on housing were these: “Welcome to California. Buy a house immediately.” This is less about California, and more about how to live with rising housing prices. This was advice given to someone who moved there for a job in the tech industry. The advice holds true now: the sooner you buy, the better your chances of being able to buy.

Related: Top 5 Myths About Home Buying in 2020

If you think you might want to become a homeowner, I encourage you to contact us. Even if you think you cannot afford a home yet, or if you don’t know what you need to do to get started, we specialize in helping people just like you achieve the American dream of homeownership. Benchmark has been helping people get into their own home since 1999, and we’ve learned a few things along the way.

Contact your local Benchmark branch. Contact us today for personalized information. Call me yourself or request a call from me. WeI would be honored to provide you with our famous excellent service for your new loan.

Benchmark brings you home.