A Home Equity Line of Credit (HELOC) is an easy way to borrow money using your home’s value as collateral. Let’s look into how a HELOC works and whether this option is right for you.

- A home equity line of credit (HELOC) works much like a credit card. With money drawn from a HELOC, you can pay for things like home remodeling/repair fees, credit card debts, or even save it for rainy day funds.

- A HELOC’s interest rates can be significantly lower than a credit cards

How Much Can You Borrow with a HELOC?

The first step in deciding if a HELOC is right for you is knowing whether you have enough home equity to qualify. This will also determine the amount of the credit line that you’re eligible for.

Your home equity is the difference between your home’s appraised value and your mortgage balance (assuming you have an existing mortgage).

Example: HELOC for a home worth $500,000

if your home is worth $500,000 and you have 50% equity, you may be able to borrow as much as $150,000 in a Home Equity Line of Credit (HELOC).

Let’s break that down.

- If your home is worth $500,000 and you owe $250,000, your equity is 50%.

$500,000 – $250,000 = $250,000

- If your home is worth $500,000 and you don’t have a mortgage, your equity is 100% ($500,000 – 0 = $500,000).

- If your home is worth $500,000 and you don’t have a mortgage, your equity is 100% ($500,000 – 0 = $500,000).

- To estimate your possible HELOC credit limit, calculate your combined loan-to-value ratio (CLTV ratio, or your line of credit relative to your home equity). Most HELOC lenders allow a CLTV of at least 80% on your main home, sometimes higher.

To estimate, multiply your home’s appraisal value by 0.8. This is approximately how much money lenders may let you borrow against your home. With a home value of $500,000, it comes to $400,000.

$500,000 x 0.80 = $400,000

- Then, subtract the amount you still owe on your existing home loan. For our example, let’s estimate that to be $250,000.

$400,000 – $250,000 = $150,000 credit limit for our example HELOC.

So, How Does a HELOC Work?

A HELOC is a revolving line of credit with a variable interest rate, like a credit card. It also has a fixed term and a defined repayment period, like a mortgage.

A credit card’s credit limit is based on your household income and credit score. You can spend as much, up to the credit limit, or as little as you want in each billing cycle. When you get your statement, you have to make at least the minimum monthly payment, but you can choose to repay the entire statement balance if you don’t want to accrue interest. When your payment is processed, your available credit increases by the amount of your payment that went toward the balance. If a portion of your payment is going to interest, this portion will not contribute to your available credit.

A HELOC is similar, but your credit limit is also based on how much equity you have in your home. Additionally, a HELOC has two periods:

- First, there is a draw period, typically several years, during which you can borrow up to your credit limit and make interest-only payments.

- Then, there is a repayment period, generally several more years, when you can no longer borrow money but must repay your outstanding balance with interest.

What are the steps to get a HELOC?

- Apply with a Benchmark online, in person, or over the phone.

- You will be asked to submit supporting documents including photo ID, paystubs, tax returns, proof of assets, bank statements, current mortgage details, and other financial information

- If approved, Benchmark will issue an initial, conditional approval

- Benchmark will order and schedule an appraisal of your home.

- Our underwriters will check your application and make sure everything’s in order

- Your final approval will be sent by your underwriter

- Close the loan and receive funding. Since a HELOC is not a lump sum loan, you’ll receive a special account or card allowing you to access your HELOC as needed

What else should you know to decide if a HELOC might be a good choice for you?

We recognize that not every loan product is right for everyone. There are a few more things you should know about HELOCs.

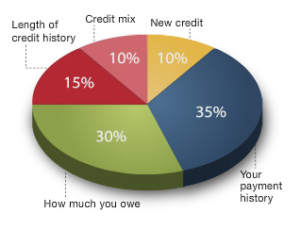

- Like most credit, the better your credit score and credit history, the higher the chances are that you will be approved.

- A HELOC is a very low cost way to borrow money, and can be an attractive option if you do not have a substantial amount in savings, and are in need due to a crisis or economic downturn.

- You can use a HELOC to pay for almost anything, and funds are easily accessible once open.

- If you feel burdened with credit card debt, and you’re looking for a way to save on interest, a HELOC could be a great tool.

Curious to learn more?

At Benchmark, we are committed to listening to your goals and setting you up for future success. To learn more, Contact your local Benchmark branch. Contact us today for personalized information. Call me yourself or request a call from me. WeI would be honored to provide you with our famous excellent service.

Benchmark brings you home.